Delivering Clean Low-Cost Energy

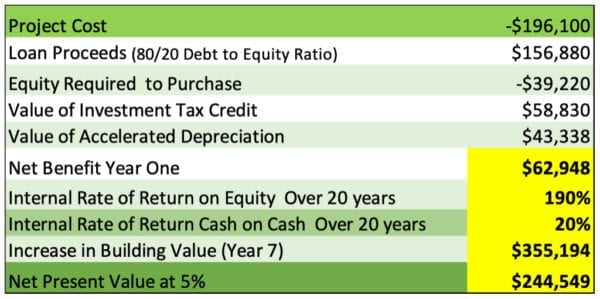

Since 2008, Entero has been serving the solar needs of customers in the small to medium size business market. These customers are currently returned more than 50% of the cost of their solar investment in year one thanks to the 30 percent Federal Investment Tax Credit (ITC) and accelerated depreciation. These incentives combined with falling costs of solar energy systems can result in TRIPLE digit returns on equity.

Our focus in Commercial Solar is leveraging our extensive experience in:

- New Construction Projects. New construction represents opportunity to optimize design but increases complexity due to more options and stakeholders. With over 50 new construction projects under our belt project owners are ensured a smooth and efficient solar installation.

- SBA Financing. SBA borrowers can take advantage of the SBA Energy Loan which triples a small business owner’s SBA borrowing eligibility; eligibility goes from $5,000,000 to $16,500,000.

- PACE Financing. Property Assessed Clean Energy (PACE) financing ties financing to a building’s property taxes thereby increasing credit worthiness while helping building owners pay the upfront cost of green energy investments.

- Solar Hybrid Technology. Solar hybrid energy systems pair solar electric integrated with solar thermal and/or solar storage for maximum power density. As customers look for more ways to be carbon neutral and to get the most out of solar energy they are looking to hybrids.

- Redefining the New Roofs and Replacement Roofs for the Investment Tax Credit. We deploy bifacial panels which require reflective roof surfaces that are therefore considered part of the solar system by the internal revenue service. This vastly increases returns on investment when a building owner is constructing a new building or is nearing the useful life of their existing roof.

Community Scale Solar Power Plants

Since 2012, Entero has been developing community scale (less than 10 megawatts) solar power plants. We work with building and land owners to redefine their roofs and land as profit centers, we work with corporate power buyers to lock in power costs and lower carbon footprint, and we work with investors to obtain long-term and sustainable revenue streams. We are now developing projects in Economic Opportunity Zones (“OZ”) that allow investors with capital gains tax liability to reduce and defer for seven years while paying zero capital gains on OZ investments as long as they are held for 10 years.